The Canada Revenue Agency has started accepting application for the much-awaited Canada Emergency Rent Subsidy (CERS) program. CERS provides a subsidy to help pay rent or mortgage expenses for businesses who have experienced certain revenue losses during the COVID-19 pandemic.

The CRA will collect applications over the coming days and, on November 30, 2020 process applications received to date. Qualifying organizations whose claims successfully clear the CRA’s automated verification system and that are registered for direct deposit should expect to begin receiving payments starting on December 4. Direct deposit payments take 3 to 8 days. A cheque takes about 14 days.

The Canada Emergency Rent Subsidy (CERS) and the Lockdown Support subsidy for commercial tenants provide eligible organizations with commercial rent and mortgage support until June 2021. The eligible organizations will apply for and receive the subsidies directly, without the need of the participation of their landlords.

Quick facts you need to know about CERS:

- CERS will apply retroactively to provide eligible organizations affected by COVID-19 with rent and mortgage support from September 27, 2020 to June 2021.

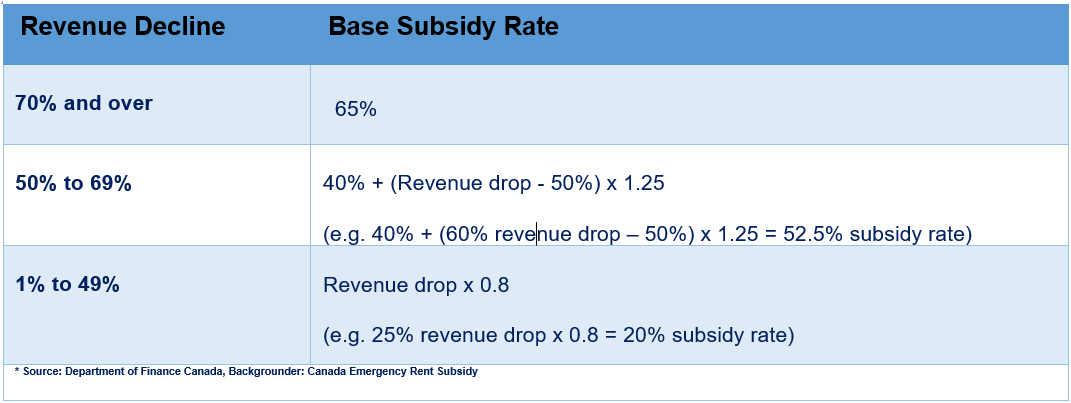

- The subsidy rate will vary depending on the eligible organization’s revenue decline.

- CERS supports businesses, charities, and non-profits that have suffered a revenue drop by providing support up to a maximum of 65% of eligible expenses.

- Qualifying businesses and organizations that were required to shut down or significantly limit their activities under a public health order will have access to additional top-up subsidy of 25%, which means that they could receive rent or property expenses support of up to 90%.

- Initially, the subsidy will apply to an eligible organization’s qualifying rent expense incurred during any of the following qualifying periods:

- September 27 to October 24, 2020;

- October 25 to November 21, 2020; and

- November 22 to December 19, 2020

The government may prescribe additional qualifying periods, with revised program parameters, following December 19, 2020 and ending no later than June 30, 2021.

Does your business qualify for CERS?

In order to be eligible for the rent subsidy, organizations must either:

- have a payroll account as of March 15, 2020 (or have been using a payroll service provider); OR

- have a business number as of September 27, 2020 and be able to satisfy the Canada Revenue Agency (CRA) that the organization’s claim is a bona fide rent subsidy claim. Additional eligibility requirements may be prescribed in the future.

Eligible organizations will be required to submit an application to the CRA by no later than 180 days after the end of the applicable qualifying period.

How is the revenue drop calculated?

- The revenue for the purposes of determining CERS eligibility is the revenue generated from its ordinary activities in Canada earned from arm’s length sources.

- Revenue does not include revenue generated from extraordinary items and amounts on account of capital.

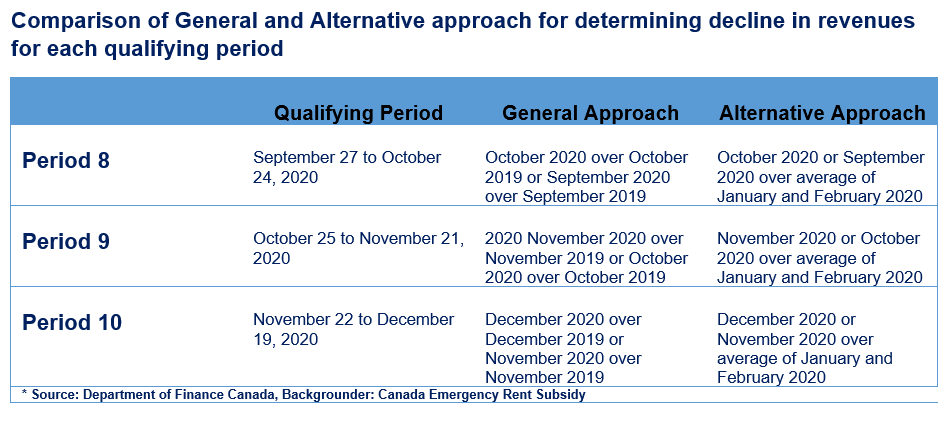

Organizations are able to calculate their drop in revenue in one of two ways, but the basis of this calculation must remain the same for each of the three qualifying periods listed above.

Approach 1:

The first approach for determining revenue decline is to compare the organization’s monthly revenue, year-over-year, for the applicable calendar month. E.g. Comparing monthly revenues of September 2020 to September 2019.

Approach 2:

The second approach is to compare the organization’s current reference month revenues against the average of its January and February 2020 revenues.

Given the above criteria, businesses that did not have any revenues in 2019 nor in January & February 2020 may not qualify for the rent subsidy. Organizations are required to use the same approach in calculating revenue decline for the purposes of determining available support under the Canada Emergency Wage Subsidy program.

Regardless of the approach taken, eligible organizations may choose either of the two months within each qualifying period for the purposes of calculating revenue decline (ex: September 2020 or October 2020 for the first qualifying period listed above). An eligible organization would use the greater of its percentage revenue decline for the current qualifying period and that for the previous qualifying period in order to calculate its rent subsidy.

What is a qualifying rent expense?

The subsidy will apply to a portion of an eligible organization’s “qualifying rent expense” for the applicable qualifying period, which includes:

- Eigible rent expense is an expense that is: (i) paid to an arm’s length entity under written agreements entered into before October 9, 2020 (and any extension of those agreements); and

- related to a “qualifying property”, being commercial real estate located in Canada which the qualifying organization uses in the course of its ordinary activities.

- A qualifying rent expense for each qualifying period is limited to $75,000 per qualifying property and is subject to an overall limit of $300,000 for each eligible organization and any of its affiliated entities.

For commercial tenants, a qualifying rent expense will include rent for the use of, or right to use, the qualifying property, including:

- gross rent;

- percentage rent;

- amounts paid under a net lease, such as base rent, operating expenses, property taxes (including school taxes and municipal taxes) and property insurance.

A qualifying rent expense for commercial tenants will not include:

- sales taxes;

- amounts paid as damages;

- amounts paid under a guarantee, security or similar indemnity or covenant;

- payments arising due to default under the agreement by the eligible organization;

- interest and penalties on unpaid amounts;

- fees payable for discrete items or special services; and

- reconciliation adjustment payments.

For eligible organizations that own the qualifying property, a qualifying rent expense will also include:

- mortgage interest (subject to limits),

- insurance costs and realty taxes provided that: (i) the eligible organization does not use the qualifying property primarily to earn rental income; or (ii) where the qualifying property is used primarily by the eligible organization to earn rental income from a non-arm’s length entity,

- the qualifying property is not used by such non-arm’s length entity primarily to earn rental income.

Anti-Avoidance Measures and Penalties

The same anti-avoidance measures and penalties that apply to CEWS will also apply to CERS (with necessary modifications to capture artificially inflated qualifying rent expenses as well as artificially deflated revenues).

Specifically, the legislation contains a targeted anti-avoidance rule which will deny CERS to an otherwise eligible entity where: a) the eligible entity, or a non-arm's length person or partnership, enters into a transaction or participates in an event (or a series of transactions or events) or takes an action (or fails to take an action) that has the effect of reducing the qualifying revenues or increasing the qualifying rent expenses for the applicable qualifying period; and b) it is reasonable to conclude that one of the main purposes of the transaction, event, series or action is to cause the eligible entity to qualify for CERS.

Further, any eligible entity subject to the above provision is liable to an additional penalty of 25% of the value of the CERS amount claimed.

At N&R CPA, we understand the uncertainty and challenges your business is facing and are proud to have been supporting our clients in navigating through various government subsidy and assistance programs to ensure you receive maximum benefit from various government programs. If you need further information on this program or need our assistance to apply for this and other government programs, do not hesitate to contact us to discuss how our services could help you and your business.

Useful links: